Introduction.

Starting a business without initial capital may seem daunting, but it’s possible to secure a startup loan even with little to no personal funds. This guide outlines the key steps to getting a loan and what options are available for startups.

1. Understand Different Loan Options

There are several loan options available, even if you don’t have upfront capital:SBA Microloans: Backed by the Small Business Administration (SBA), these loans offer up to $50,000 and are designed for startups.

Business Credit Cards:

If used wisely, business credit cards can provide short-term liquidity without upfront capital.Crowdfunding Platforms: Platforms like Kickstarter or GoFundMe allow you to raise money for your startup through the community.Peer-to-Peer Lending: Websites like LendingClub connect borrowers with investors willing to lend money at reasonable rates.

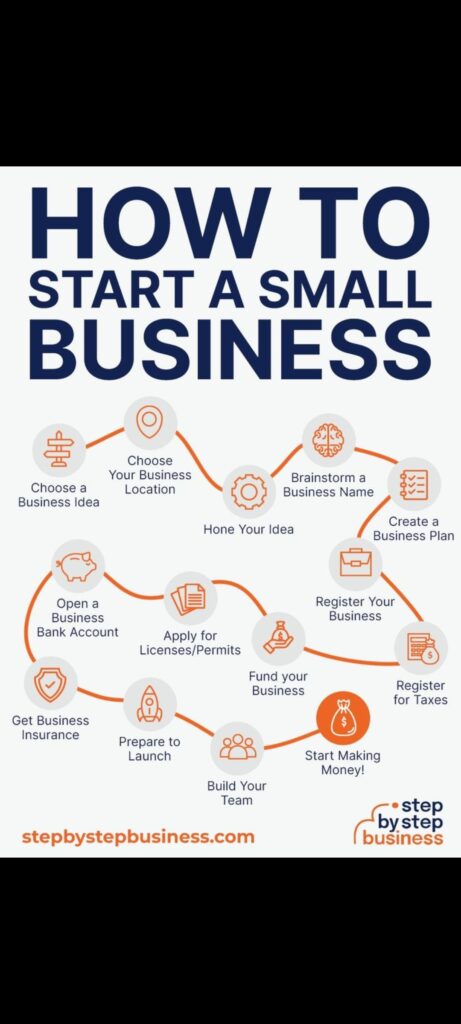

2. Build a Solid Business Plan

Lenders want to see a detailed plan for how their money will be used and how your business will generate revenue. A business plan not only outlines your business model but also shows that you’ve thought critically about how to succeed.

3. Improve Your Credit Score

While no-money-down loans are possible, lenders will often review your personal credit score to assess your financial responsibility. If your credit score is low, work on improving it by paying off existing debt and making timely payments.

4. Find the Right Lender

Not all lenders require collateral or significant upfront capital. Research lenders that specialize in startup loans or microloans for entrepreneurs with minimal assets.

5. Consider a Co-Signer or Partner

If you can’t qualify for a loan on your own, consider partnering with someone who has a stronger financial background or credit history. A co-signer can help you secure a loan with better terms.

Conclusion

While starting a business with no money is challenging, it’s entirely possible to secure a loan by understanding your options, preparing a solid business plan, and improving your credit score. Explore creative financing solutions to get your startup off the ground.

Leave a Reply